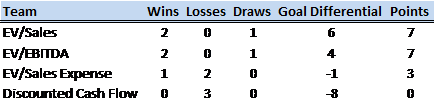

*Editor’s Note: Keep up to date on all things Valuation World Cup here!

The day we have all been waiting for is here! Two of the early favorites have lived up to the hype and advanced to the VWC Finals! Though the methods have taken different paths, they both remained committed to their team and investment rationale.

Matchup:

Group B Winner (EV/Sales) vs. Group D Winner (Acquisition Value (Attach Rate))

Highlights:

Acquisition Value (Attach Rate) had been a nearly unstoppable force throughout the tournament with timely scoring and full team efforts and this beginning of this game was no exception. They got out to an early 1-0 lead due to their ability to size up the competition regardless of market factors and ensure its fit within the business model of the acquiring company. EV/Sales took this initial deficit in stride and made an inspired push to end the 1st half but could not equalize.

When the pundits look back at the Inaugural Valuation World Cup in the history books 20 years from now, they will most remember the final as a tale of two halves. The first half was Acquisition Value (Attach Rate) continuing its dominant pace of play that had gotten it this far. It was the hot metric, with some big name press as of late. When Mr. Andreessen tweets 14 times about something, you take note. But you know else got a lot of press this World Cup? Tyranno-Suarez Rex.

In the second half, the Acquisition Value (Attach Rate) supporters’ deepest fears were confirmed in that the Achilles heel of the entire team was the fact that the Attach Rate was only as good as the acquiring company’s analysis and as a result could be fairly niche and hard to value at times. This confusion was brought on by EV/Sales change in formation from a pedestrian 4-4-2-1 to an attacking 4-2-3-2 and only made worse by an own goal. Acquisition Value (Attach Rate) was accustomed to the initial formation and when EV/Sales switched, it fell into an unrecoverable spiral similar to when a company buys a target and then it turns out to be a horrible deal for the acquirer (we see you HP-Autonomy…).

After the formation change, Acquisition Value (Attach Rate) looked as bad as Wesley Sneijder’s repeated failed attempts to cross a ball into the box in the Argentina game and it was all downhill from there. EV/Sales caps off the comeback and with an absolute FIRECRACKER in the 85’ minute due to their reliance on a tried and true method.

Outcome:

EV/Sales 2 : 1 Acquisition Value (Attach Rate)

And a Bonus!

Golden Metric Award:

Despite a tough loss in the final, the Golden Metric was awarded to Acquisition Value (Attach Rate). They won all three games in their Wild Card Group D against some wily opposition, outscored opponents 9-1 in their first two knockout stage games, and gave the mighty EV/Sales a run for their money (get it?) in the final. As technology behemoths sit on PILES of cash and command high stock prices, we could see a buyer’s market for years to come.